Yes!! You should buy Corona Kavach even if you are having and a must for those not having health insurance. If you are travelling to

Author: bluefinvest

Smart Tax Saver Beyond Section 80 C.

Under Section 80C of the Income Tax Act, a taxpayer can avail tax deduction benefits worth up to Rs.1.5 lakh p.a. You can invest in

How To Choose The Right Health Insurance For You Easily.

Even before one starts investing in one’s goals, getting adequate health insurance coverage for self and family helps. Undeniably, health insurance is one of the most

Know How Safe Is Your Bank Account.

The most common and popular form of deposit among us which is considered to be the only safe instrument in India is quite shaken, After

Top 10 Reasons You Should File Your Income Tax Now.

Have you filed your income Tax? Most millennials think that if their salaries fall below the taxable bracket they shouldn’t be filing ITR (Income Tax

How To Use Your Bonus Effectively.

Bonus season is nearby many multi-national companies in India have a culture of giving out Yearly bonus, year-end bonus, or performance bonus. It is more

What Is Market Cap, Large-Cap, Mid-Cap And Small-Cap.

There are approximate 4800 listed stocks in our NSE & BSE stock exchanges. So how do you define your investment to be invested in Large

Top Reasons For Not Buying Term Insurance

Term Insurance or Income protection which will provide financial coverage during your unexpected absence. Because of Term Insurance not only does your family remains financially

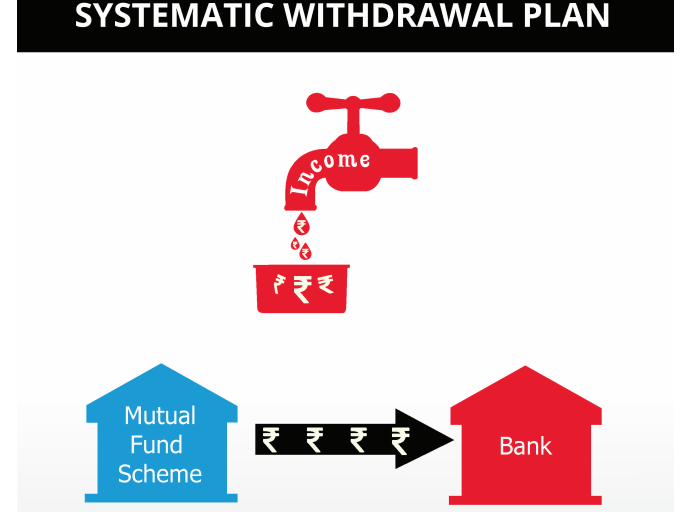

All About SWP And How To Use It.

SWP or Systematic Withdrawal Plan as we say is an option of withdrawal from your Mutual Fund investment. In SWP the money is automatically deducted

Debit Card Can Give You Insurance Cover!!

Did you know that your ATM Debit card is more powerful than you thought, It has Insurance too!! ATM over the years has been used